VechainThor, with COO Kevin Feng and CEO Sunny Lu

The “internet of things” (IoT) refers to the connection of everyday objects to the Internet, enabling these objects to send and receive data. In a blockchain future, your refrigerator will sense that you are running low on eggs and trigger a smart contract that purchases a fresh dozen from your preferred grocer. Once your eggs arrive, you will scan a QR code on the carton with your smart phone and be shown a detailed history of your eggs’ journey from the henhouse all the way to your refrigerator: where the eggs were laid, whether or not they’re organic and even the temperature that they’ve been stored at so you know they’re safe for consumption.

While we’re still a far cry away from your refrigerator autonomously doing your grocery shopping, the technology capable of tracking your eggs’ journey along a supply chain already exists. Singapore’s Vechain is the company responsible for designing it.

On February 26th, Vechain CEO Sunny Lu detailed his plans to launch VechainThor, which is a public blockchain tailored for enterprise adoption. Executives from auditing and quality assurance giants PricewaterhouseCoopers and Norway’s DNV GL joined him on stage. He concluded the presentation by confirming rumors that Vechain is building blockchain solutions for multinational automaker BMW. Needless to say, Vechain already has the support of major international companies.

In the days leading up to the event, I sat down with Vechain COO Kevin Feng to discuss their plans for building the first public blockchain platform suited for enterprise use. I was even able to corner CEO Sunny Lu at the after party to get his thoughts on the future of VechainThor and public blockchains in general.

Vechain Technology – Private Solutions

Vechain is one of the few blockchain companies with the distinction of building blockchain solutions that are actually being used in the real world. Since launching in 2015, Vechain has built private blockchain solutions for clients in the luxury, wine and automotive industries.

Many of the solutions Vechain has developed involve running supply chain logistics on the blockchain. Just as the bitcoin blockchain can autonomously track thousands of daily transactions, supply chain blockchains can track the complex movements of thousands of items throughout a supply chain. The data is recorded on a tamperproof ledger that can be viewed in real time. This is accomplished by implanting smart chips or QR codes on physical items that are scanned every time the item reaches a new destination.

For an undisclosed French luxury handbag company, Vechain embedded computer chips in each handbag that recorded every step in its journey from manufacturer to retailer. Each bag could then be scanned to confirm that it originated from an authentic manufacturer. This eliminated the threat of counterfeiting, which is a multi-billion dollar a year issue for the luxury industry. Vechain implemented a similar solution for Chinese wine importer DIG. Chips are embedded at the top of every wine bottle, recording each bottle’s path throughout the supply chain. Retailers can then scan these chips to confirm that the wine is authentic. If someone tries to open the bottle and replace it with counterfeit wine, the chip is destroyed, signaling that the bottle has been compromised.

Vechain expanded its repertoire beyond supply chain logistics with French car manufacturer Renault Group. For Renault, Vechain built a blockchain solution that essentially creates a unique digital identity for each vehicle – mileage, maintenance history and insurance information are securely recorded to the blockchain.

Vechain app in action - scanning an NFC Chip reader in a bottle of wine pic.twitter.com/W8pdRK6cDy

— Connor Dempsey (@CryptoAmbit) February 26, 2018

Private vs. Public Blockchains

While Vechain’s clients are happy with these solutions, they are limited because they are being implemented on private blockchains. Unlike public blockchains like Bitcoin and Ethereum that are open to anyone for use, private or permissioned blockchains are restricted to authorized participants. Private blockchains miss out on the network effects that come from free and open collaboration.

If we want our refrigerators ordering eggs from the grocery store that are verifiably safe for consumption , we need the egg producer, grocery store and refrigerator company building solutions under the same blockchain. VechainThor aims to be that public blockchain.

VechainThor – Blockchain For Enterprises

So why not just build these solutions for enterprises on existing public blockchain platforms like Ethereum? After all, Vechain’s private blockchain solutions were built using Ethereum’s open source code.

According to COO Kevin Feng, Vechain has gotten extensive feedback from its partners PricewaterhouseCoopers (PwC) and DNV GL indicating that there are certain aspects of public blockchains like Ethereum that make their large enterprise clients uneasy. These issues are two-fold:

1. Lack of a stable governance model

2. Lack of economic stability

Through my conversation with Kevin, I learned that VechainThor was designed to eliminate the hurdles that prevent large enterprises from building solutions on top of public blockchain infrastructure.

Improved Governance

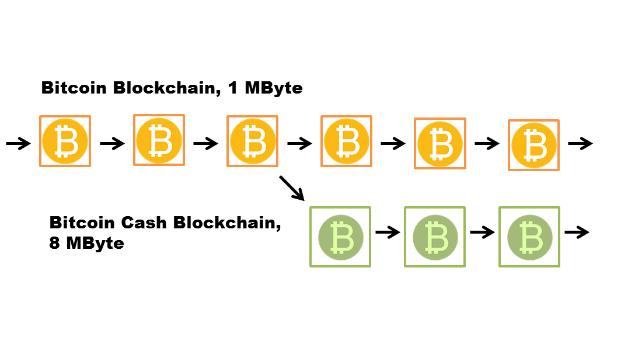

If you’ve followed Bitcoin’s history, you know that it is rife with contentious debates amongst users, programmers and miners. The most famous of these is the “block size” debate, which was basically a disagreement over how to scale the Bitcoin Network to handle more users and transactions. By design, Bitcoin has no central governance structure and instead has processes in which the entire network collectively makes decisions, which can get messy. The block size debate was particularly messy and ultimately led to a “hard fork” in which the community split into two blockchains – Bitcoin and Bitcoin Cash. Similarly, when the Ethereum community was divided over how to handle a major security breach, one camp ultimately hard forked into Ethereum Classic.

While lack of a central authority is one of the major tenants of the decentralized movement in which Bitcoin and Ethereum are built, the instability that comes from effectively having no one in charge makes large enterprises uneasy. Thus, VechainThor has a more formalized system for making decisions that comes in a form that modern enterprises are familiar with: a committee.

The VechainThor Steering Committee consists of 7 members:

- 3 members of the Vechain Foundation

- 2 executives from DNV GL

- 1 executive from Price Waterhouse Coopers

- 1 independent member from Hong Kong City University

With the Steering Committee in place, VechainThor has formal procedures for making decisions that affect the overall stability of the network. For example, if scalability issues arose on the VechainThor blockchain, there is a “Technical Committee” tasked with proposing solutions to the Steering Committee. If several viable solutions were presented, the Steering Committee would put forth the ultimate decision to be voted on by the users of the VechainThor network. With the Steering Committee in place, Vechain can make decisions on contentious and critical issues without the risk of hard forks or division of the network.

Proof-of-Authority Consensus Mechanism

All blockchains are made up of a computer network that maintains a shared ledger of transactions. The process in which they agree on the state of the shared ledger is called a consensus mechanism. Bitcoin and Ethereum use “proof-of-work” in which anonymous computers (miners) compete to solve a complex mathematical problem, with the winner updating the ledger and getting rewarded for it. If software developers propose a change to the Bitcoin or Ethereum network and the miners refuse to upgrade their software, the change will not go into effect. This gives miners immense influence over the network.

If Vechain employed this same system and the Steering Committee reached a decision, it would still be up to the miners whether or not to implement it by updating their software. This would effectively negate the point of having a Steering Committee. To avoid this, Vechain employs Proof-of-authority, where all miners are first vetted by the Vechain Foundation and obligated to maintain certain standards.

VechainThor will have 101 vetted miners known as “Authority nodes” whose identities will be public information. Once approved, they will maintain the hardware that validates transactions on the VechainThor blockchain and receive financial rewards for doing so. While they will have the ability to vote on changes to the VechainThor network, they are obligated to implement changes once the vote is final; failure to do so will result in their rights being revoked. This ensures that decisions reached by the VechainThor network can be implemented with finality.

2 Token Economic Model

According to Kevin and Sunny, beyond the lack of governance, a primary reason that enterprises aren’t using public blockchains in any meaningful capacity is because the cost to use the network is too unpredictable. The example they cite is Ethereum and the network’s native currency, Ether. To power applications on the Ethereum network, you must pay in Ether. The price of Ether is directly tied to the value of the Ethereum network, which is subject to wild fluctuations.

To separate the value of the network from the cost of using the network, VechainThor employs a two-token system consisting of VET and VeThor. VET must be purchased to access the network and VeThor tokens are needed to fuel individual actions on the VechainThor blockchain. For example, Wine importer DIG would be required to hold a certain amount of VET to gain the rights to use the platform; they will have to pay small amounts of VeThor to have new location data for their wine bottles recorded to the blockchain.

Just like certain stocks produce dividends, VET produces VeThor. For every 1 VET someone holds, .00042 VeThor tokens are generated every day and credited to the user’s account. This will allow enterprises to calculate their costs and buy the appropriate amount of VET. For example, DIG could estimate that they’ll need 3000 VeThor to cover their Vechain smart contract activity for the year. Instead of purchasing the VeThor directly, they can make a one-time purchase of 20,000 VET that would generate sufficient amounts of VeThor each year (note: purely made up numbers).

In order for enterprises to be able to reliably estimate how much VeThor they will need to run their operations, the price of VeThor must remain relatively stable. To accomplish this, the Vechain Foundation is developing mechanisms that keep the price of VeThor under control. These mechanisms will monitor both the supply, consumption and price of VeThor and adjust the rate in which VeThor is generated when certain price thresholds are reached, thus controlling the supply. For example, if speculators were bidding up the price of VeThor on the open market, the rate in which VET tokens generate VeThor tokens would increase. This increase in supply would then offset the increase in price. These adjustments will be automated based on economic models that the Vechain Foundation is developing with professors at several top universities. These models will be disclosed to the public once VechainThor goes live.

Kevin also told me that there will be options for enterprises to use Vechain as a service without actually having to interact with the VET and VeThor tokens. Vechain can simply price out the cost of VechainThor services for the enterprises in fiat dollars. For example, Vechain could calculate the total cost of the chips that DIG Wine needs to run their anti-counterfeiting solution along with the total VeThor needed to fuel the smart contracts and quote DIG one fiat price. For the enterprise, it won’t be different from paying for any other service even though it involves cryptocurrencies and a public blockchain. Kevin also envisioned that eventually we’d see entire businesses that serve as intermediaries for large enterprises, who handle the cryptocurrency side of running operations on a public blockchain. He even speculated that Vechain partner DNV GL may take on this role for certain clients, given their familiarity with the platform.

Key Partnerships

Vechain believes that it has designed a public blockchain that enterprises will be willing to adopt due to more stable governance and economic models. Whether or not enterprises actually adopt public blockchain solutions using Vechain Thor remains to be seen. With strong partners in DNV GL and PricewaterhouseCoopers, it’s a goal that certainly seems within reach. After all, it’s no coincidence that two executives of DNG VL and one from PwC will be sitting on the Vechain Thor Steering Committee.

DNV GL

While Norway’s DNV GL may not be a household name, they are a massive quality assurance and risk management company with over 80,000 enterprise clients operating in industries around the world. The company is undergoing what it calls a, “global digital transformation” that will employ digitization and big data to solve various challenges its clients face across industries. DNV GL sees blockchain as the future of its business assurance division, which designs and maintains quality assurance programs, including supply chains, for its clients.

At last Monday’s event, CEO of DNV GL’s Business Assurance sector, Luca Crisciotti, stated that after meeting with over 20 blockchain companies, they ultimately partnered with Vechain because of their experience building actual working blockchain solutions for real customers. He also emphasized just how many working technologies the company has already developed with Vechain; not just prototypes. He then alluded to an announcement DNV GL will be making about one of these solutions at Tokyo’s Global Food Safety Conference next week. Given DNV GL’s commitment to a complete digital transformation and their strong partnership with Vechain, it seems likely that many of their clients will be running operations on VechainThor in the near future.

PricewaterhouseCoopers

PwC is responsible for auditing thousands of the world’s largest enterprises. Given blockchain’s capacity for creating tamperproof records of transactions, its application in revolutionizing audit processes for PwC’s clients is obvious. With over 100,000 clients all over the world, including over 80% of the Fortune Global 500, the partnership should open a lot of doors for Vechain.

Beyond providing exposure to potential users of the VechainThor platform, PwC is a vital partner because of its strong understanding of compliance and regulation across a diverse array of industries in regions all over the world. If VechainThor wants enterprises around the world to build applications on its platform, it needs them to remain compliant with their respective regulators. Kevin said that PwC has been integral in advising VechainThor on governance, and KYC (know-your-customer) protocols that will enable enterprise users to remain compliant. With regulators from the United States to Kazakhstan all focusing on blockchain and cryptocurrency regulations in 2018, PwC will be critical in helping VechainThor remain compliant in a fast changing regulatory environment.

Going Forward

I asked Kevin how Vechain plans to get enterprises building applications on the VechainThor blockchain. He compared their approach to Apple in the early days of the IOS app store. Early on, Apple built the majority of applications to attract users. Once the platform caught on, it attracted 3rd party developers who today build the overwhelming majority of applications.

Vechain will continue to use its expertise and proprietary IoT technology to build end-to-end blockchain applications for its clients on VechainThor. The more real world applications that are running on VechainThor, the more enticing it will be for other enterprises to develop solutions that can interact with existing applications. For example, if all Renault and BMW vehicles are storing unique vehicle identity data on the VechainThor blockchain, an insurance company may want to build an application that can interact with that data and automatically issue insurance policies on the blockchain.

One of the first public dApps (decentralized applications) launching on VechainThor is called VeVID - short for Vechain Verified ID. This is a KYC (know-your-customer) application being developed with Japanese Bitcoin ATM manufacturer BitOcean. BitOcean has already developed KYC processes that allow its customers in Japan to use their Bitcoin ATMs in a manner that is compliant under Japanese regulations. Vechain and BitOcean will be migrating these KYC services onto VechainThor so that enterprise users can register their identifies to the platform while remaining compliant to KYC regulations of various regulators.

Thoughts From Sunny Lu

At the after party on the rooftop of Singapore’s Andaz Hotel, I was able to corner Sunny at the bar for questioning. I asked him how he was sure that companies that are already happy with private blockchain solutions would want to use public blockchains like VechainThor. His answer: the same reason they use open Internets over closed intranets – open systems offer network effects that closed systems do not.

He then reflected on his time as an IT infrastructure engineer where he was tasked with building LANs – “limited access networks” consisting of a small number of interconnected computers. He compared private blockchains to LANs, stating that even though they serve their purpose, they lack the potential to evolve into something greater.

“Why build a supply chain for one company on a private blockchain when you can build one supply chain for an entire industry on a public one.”

Disclosure: I own some VEN (soon to be VET)

Please like and subscribe below and share on social media! Follow me on twitter @cryptoambit